Table of Contents

Beyond Vanity: The Metrics That Truly Define Product Success

For executives and product leaders, distinguishing between vanity metrics and actionable insights is the difference between stagnation and sustainable growth. It’s easy to get lost in a sea of data, but which numbers truly matter? The right data doesn't just report on the past; it illuminates the path forward, enabling strategic decisions, optimizing resource allocation, and ultimately, building products that customers love and value. This guide moves beyond the surface, providing a comprehensive roundup of the 7 key product metrics essential for any data-informed leader.

We will explore not just what each metric is, but how to calculate it, why it's critical, and how to leverage it to drive meaningful results. This isn't just a list; it's a playbook for product excellence grounded in strategic decision-making. The principles of using data for performance are universal. You can explore how even hotel businesses leverage understanding essential KPIs to boost performance.

This article provides the framework to validate your strategy and scale your operations by focusing on the specific metrics that matter most. We will cover:

- Monthly Active Users (MAU)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV/LTV)

- Churn Rate

- Net Promoter Score (NPS)

- Product-Market Fit Score

- Activation Rate

1. Monthly Active Users (MAU)

Monthly Active Users (MAU) is one of the most fundamental key product metrics, representing the number of unique users who engage with your product within a given 30-day period. It serves as a primary indicator of your product's overall health, reach, and market penetration. For platforms like social networks (Facebook), streaming services (Spotify), and SaaS businesses, MAU is a vital sign of user base scale and potential monetization opportunities.

Defining 'Active' and Tracking Trends

The true power of MAU lies not in its absolute value, but in its definition and trend analysis. A common mistake is to define "active" too broadly, such as a user simply logging in. A more insightful approach is to tie activity to a core value-driving action. For a collaboration tool like Slack, an active user might be someone who sends a message. For an e-commerce platform, it could be a user who views a product or adds an item to their cart.

Tracking MAU over time reveals your product’s growth trajectory. A steadily increasing MAU signals healthy acquisition and retention, while a stagnant or declining number can be an early warning of market saturation, competitive pressure, or declining user interest. This trend is far more critical for strategic decisions than a single month's snapshot.

Implementation and Actionable Insights

To get the most out of this metric, segment your MAU data. By breaking down active users into cohorts based on acquisition date, demographics, or behavior, you can uncover deeper patterns. For example, you might discover that users acquired through a specific marketing campaign have a higher retention rate, informing future budget allocation. Combining MAU with engagement depth metrics, like session duration or feature adoption rates, provides a more complete picture of user health.

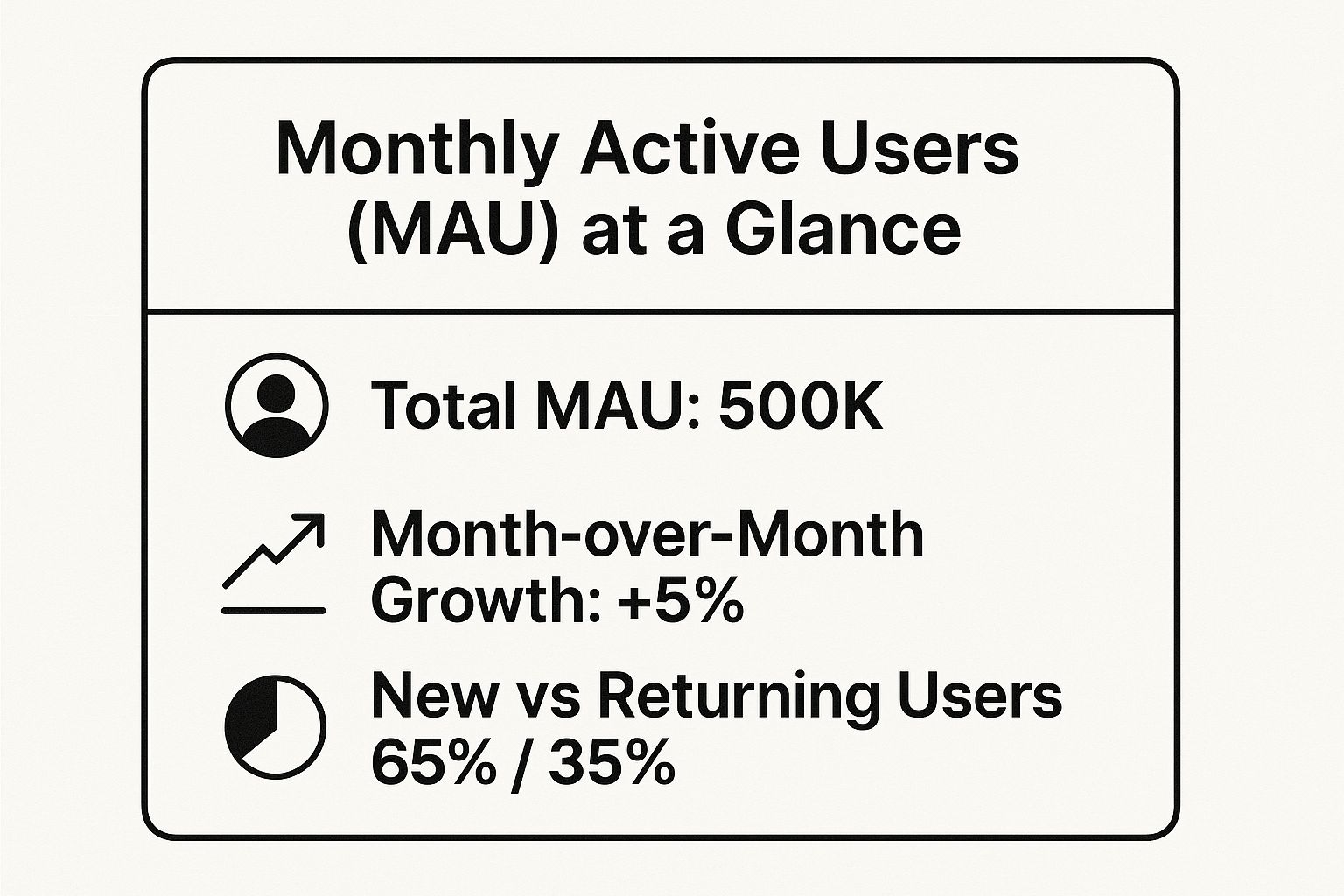

For a practical example, this infographic visualizes a sample company's MAU data, breaking it down into growth and user composition.

The visualization shows a healthy 5% month-over-month growth, but also highlights that a significant majority (65%) are returning users, indicating strong product stickiness. For two-sided platforms, understanding MAU is a critical component of building effective marketplace growth strategies. By consistently monitoring and dissecting these numbers, product leaders can make more informed decisions to drive sustainable growth.

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is a critical key product metric that measures the total cost of acquiring a new paying customer. This includes all sales and marketing expenses, from ad spend and content creation to sales team salaries and software tools, divided by the number of new customers acquired in a specific period. For any business model, but especially for SaaS, e-commerce, and subscription services, CAC is a direct indicator of the efficiency and sustainability of your growth engine.

Calculating a Fully-Loaded CAC

The true utility of CAC comes from an honest and comprehensive calculation. A common pitfall is only including direct ad spend. A "fully-loaded" CAC, however, provides a much more accurate picture by incorporating all associated costs: salaries for your marketing and sales teams, creative and technical contractor fees, and even the software and tools they use. This complete view prevents you from underestimating the true cost of growth.

You should also differentiate between "blended" CAC (all customers divided by all costs) and "paid" CAC (customers from paid channels divided by paid marketing costs). This segmentation helps you understand the efficiency of your paid marketing efforts in isolation from organic or word-of-mouth channels, allowing for more precise budget adjustments.

Implementation and Actionable Insights

Effective CAC analysis goes beyond a single number. The real insights emerge when you track CAC trends over time and segment the data. For instance, an e-commerce brand might analyze CAC for each advertising platform (e.g., Google Ads vs. Facebook Ads) to see which channel delivers the most cost-effective customers. Similarly, a B2B SaaS company can calculate CAC for different customer segments or tiers to ensure acquisition spending aligns with potential revenue.

The most powerful application of CAC is comparing it to Customer Lifetime Value (LTV). A healthy business model requires that LTV is significantly higher than CAC (a common benchmark is an LTV:CAC ratio of 3:1 or higher). This ensures each new customer generates a profit over their lifespan. Understanding this balance is fundamental to the capital-efficient principles discussed in The Lean Startup methodology. By continuously monitoring and optimizing CAC, product leaders can build a scalable and profitable growth strategy rather than simply buying "empty" growth.

3. Customer Lifetime Value (CLV/LTV)

Customer Lifetime Value (CLV or LTV) is a predictive metric that forecasts the total revenue a business can expect from a single customer account throughout their entire relationship. It's one of the most crucial key product metrics for sustainable growth, shifting focus from short-term gains like a single purchase to the long-term health of the customer relationship. For subscription-based businesses like Netflix or SaaS platforms, CLV directly informs decisions on customer acquisition costs, retention strategies, and product development.

Defining 'Value' and Tracking Trends

Calculating CLV involves more than just summing up past purchases; it requires predicting future behavior based on average purchase value, purchase frequency, and customer lifespan. A simple formula is (Average Transaction Value) x (Number of Transactions per Period) x (Expected Customer Lifespan). However, more sophisticated models incorporate factors like customer churn rate and discount rates for future revenue. The real power comes from tracking CLV trends over time. A rising CLV indicates that your customers are becoming more valuable, a sign of increasing loyalty, successful upselling, or improved product stickiness.

For example, Starbucks masterfully uses CLV to shape its loyalty program. By understanding the long-term value of a daily coffee drinker, it can justify offering rewards that might seem costly upfront but are highly effective at extending customer lifespan and increasing purchase frequency, thereby maximizing overall CLV.

Implementation and Actionable Insights

Effective CLV analysis relies on segmentation. By calculating CLV for different customer cohorts, you can identify your most profitable segments. For instance, you might discover that customers acquired via organic search have a 50% higher CLV than those from paid social media campaigns. This insight allows you to reallocate marketing spend towards more valuable channels. The most common benchmark for this metric is the CLV to Customer Acquisition Cost (CAC) ratio. A healthy ratio is typically considered to be 3:1 or higher, meaning the value a customer brings is at least three times the cost of acquiring them.

To get the most from this metric, update your CLV calculations regularly as your product, pricing, and customer behavior evolve. Using cohort analysis will provide a much more accurate picture than a single, company-wide average. By integrating CLV into your strategic planning, you move beyond simple revenue tracking and make data-driven decisions that foster long-term, profitable customer relationships, a cornerstone of any successful product-led growth strategy.

4. Churn Rate

Churn Rate is one of the most critical key product metrics, measuring the percentage of customers who stop using your product or cancel their subscription within a specific time period. Often seen as the nemesis of growth, churn directly erodes your customer base and revenue, potentially negating even the most successful acquisition efforts. For subscription-based businesses like SaaS platforms, streaming services, and mobile apps, a high churn rate can signal significant issues with product-market fit, customer satisfaction, or the overall value proposition.

Understanding the 'Why' Behind Churn

Simply tracking the top-line churn number isn't enough; you must dig deeper to understand its drivers. A crucial first step is to differentiate between voluntary and involuntary churn. Voluntary churn occurs when a customer actively decides to leave, often due to dissatisfaction or finding a better alternative. Involuntary churn happens when a subscription ends due to an external factor, like a failed payment. While both are problematic, they require different solutions.

Segmenting your churn data by customer cohorts, acquisition channel, or pricing plan can reveal powerful insights. For instance, you might find that customers acquired through a specific marketing campaign churn at a higher rate, or that users on a lower-tier plan are more likely to leave. This level of analysis turns a reactive metric into a proactive tool for strategic decision-making and is a core component of effective product risk management.

Implementation and Actionable Insights

To combat churn effectively, product leaders must implement systems to identify at-risk customers before they leave. This can involve tracking product usage patterns, such as a decrease in login frequency or feature adoption, and combining this quantitative data with qualitative feedback from surveys or support tickets. For example, a streaming service might analyze churn rates immediately following a price increase to gauge customer price sensitivity. Similarly, a mobile app could measure churn specifically for users who fail to complete the onboarding process, highlighting a potential friction point.

Understanding your churn rate is crucial, and it's equally important to know how to act on this metric. You can explore data-driven strategies to effectively reduce customer churn to develop a comprehensive retention plan. By combining these proactive measures with a deep analysis of why customers leave, you can build a more resilient product that fosters long-term loyalty and sustainable growth.

5. Net Promoter Score (NPS)

Net Promoter Score (NPS) is a widely adopted metric that measures customer loyalty and satisfaction, making it one of the most crucial key product metrics for understanding user sentiment. It gauges how likely customers are to recommend your product or service to others on a scale of 0-10. This single question provides a powerful, standardized benchmark for tracking customer advocacy and predicting business growth, famously used by companies like Apple and Tesla to gauge their brand's health.

Defining Promoters, Passives, and Detractors

The elegance of NPS lies in its simple yet insightful categorization. Respondents are grouped based on their score: Promoters (9-10) are your loyal enthusiasts, Passives (7-8) are satisfied but unenthusiastic customers vulnerable to competitive offerings, and Detractors (0-6) are unhappy customers who can damage your brand. The final NPS score is calculated by subtracting the percentage of Detractors from the percentage of Promoters, resulting in a score ranging from -100 to +100.

Tracking this score over time is more valuable than focusing on a single number. A rising NPS indicates that product improvements and customer service initiatives are resonating with users, while a decline can be a leading indicator of churn or underlying product issues that need immediate attention. For a deeper dive into how to effectively measure customer sentiment and satisfaction, consider exploring more about customer satisfaction measurement methods like NPS.

Implementation and Actionable Insights

To maximize the value of NPS, always follow up the quantitative question with a qualitative one, such as "What is the primary reason for your score?". This feedback provides the critical "why" behind the number. Segmenting NPS data by customer journey stage, user persona, or product tier can reveal specific pain points or moments of delight. For instance, you might discover that new users have a lower NPS, pointing to a need for better onboarding.

The most critical step is "closing the loop," especially with Detractors. By proactively reaching out to unhappy customers to understand their issues and offer solutions, you can often turn a negative experience into a positive one, salvaging the customer relationship and gathering invaluable feedback for product development. This proactive engagement transforms NPS from a passive score into an active tool for continuous improvement and customer-centric growth.

6. Product-Market Fit Score

The Product-Market Fit (PMF) Score is one of the most vital key product metrics for early-stage products, directly measuring how well your solution satisfies strong market demand. Popularized by Sean Ellis, this metric is typically derived from a simple survey asking one critical question: "How would you feel if you could no longer use this product?" If over 40% of your users respond that they would be "very disappointed," you likely have a strong product-market fit. This provides a clear, quantitative benchmark for a concept that is otherwise qualitative and difficult to pin down.

Defining 'Fit' and Interpreting the Score

The core of the PMF Score is its focused definition of need. Unlike vanity metrics, it cuts straight to the indispensability of your product. Companies like Superhuman famously used this metric to refine their offering, refusing to scale until they achieved a 58% "very disappointed" score. This wasn't just about hitting a number; it was about ensuring they had a core group of users who truly loved the product before pursuing broader growth.

Interpreting the score requires looking beyond the 40% threshold. A score below this benchmark is a clear signal to double down on product development and user feedback, rather than investing heavily in marketing. For example, Dropbox and Slack both validated strong PMF early on, which gave them the confidence to make significant investments in scaling user acquisition. The score acts as a crucial gatekeeper, preventing premature scaling.

Implementation and Actionable Insights

To effectively implement the PMF survey, you must target the right audience. Surveying all sign-ups will dilute your results; instead, focus on users who have recently experienced the core value of your product, such as those who have been active in the last two weeks. This ensures the feedback comes from people who understand what they would be losing.

Combine this quantitative score with qualitative feedback by including an open-ended follow-up question like, "What is the main benefit you receive from our product?" Analyzing these responses, especially from the "very disappointed" segment, reveals your primary value proposition and ideal customer profile. As Rahul Vohra did with Superhuman, you can then use these insights to build an engine for improving product-market fit. Segmenting scores by user persona or acquisition channel can further guide your roadmap and marketing efforts, turning a simple survey into a powerful strategic tool.

7. Activation Rate

Activation Rate is one of the most critical key product metrics, measuring the percentage of new users who complete a predefined action or set of actions that expose them to the product's core value. This metric bridges the gap between acquisition and long-term retention, acting as a powerful predictor of which users will stick around. Unlike vanity metrics like sign-ups, activation focuses on the "Aha!" moment when a user truly understands why your product is essential.

Defining 'Activation' and Driving to the "Aha!" Moment

The real value of tracking Activation Rate comes from a precise definition of what "activated" means for your specific product. This isn't just about a first log-in; it's about experiencing the core value proposition. For example, Facebook famously discovered that users who added 7 friends in 10 days were far more likely to remain active. Similarly, for Dropbox, activation could be uploading and sharing a file, while for Slack it might be sending the first team message.

Analyzing the path to this moment is crucial. A low activation rate is a clear signal that your onboarding process is failing to guide users effectively. It highlights friction, confusion, or a disconnect between your marketing promise and the initial product experience. Improving this rate is a high-leverage activity, as activated users are significantly more likely to become engaged, retained, and paying customers.

Implementation and Actionable Insights

To effectively use this metric, start by defining a clear activation event tied directly to your product's primary value. Then, use cohort analysis to track the activation rate of users grouped by sign-up week or acquisition channel. This can reveal which channels bring in the most engaged users, helping you optimize marketing spend and messaging. For instance, you might find that users from an organic search have a 30% higher activation rate than those from a paid social campaign.

This video from Mixpanel offers a great explanation of how to define and measure your product's "Aha!" moment to improve user retention.

Continually experiment with your onboarding flow to reduce the time-to-value and remove friction points. By focusing intensely on what it takes to get a new user to their "Aha!" moment, as popularized by the AARRR framework, you directly influence future retention and monetization. An increasing Activation Rate is a leading indicator of a healthier, more sustainable business.

Key Metrics Comparison of 7 Product Indicators

| Metric | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Monthly Active Users (MAU) | Low - straightforward counting | Low - basic tracking systems | Baseline user engagement, growth trends | Subscription, social, SaaS products | Easy to communicate; standardized |

| Customer Acquisition Cost (CAC) | Medium - requires cost attribution | Medium - marketing & sales data | Measures cost efficiency of acquiring customers | Marketing channel optimization, ROI analysis | Ties marketing spend to outcomes |

| Customer Lifetime Value (CLV/LTV) | High - complex predictive modeling | High - historical & behavior data | Forecasts long-term revenue per customer | Retention strategy, budgeting, segmentation | Justifies acquisition spend; strategic planning |

| Churn Rate | Medium - retention calculation | Medium - user activity data | Indicates customer loss & satisfaction | Subscription businesses, retention focus | Directly reflects satisfaction; proactive retention |

| Net Promoter Score (NPS) | Low - survey based | Low - survey tools | Measures customer loyalty & satisfaction | Customer experience management | Simple, benchmarkable, actionable |

| Product-Market Fit Score | Low - survey based | Low - user feedback collection | Validates product demand & readiness for growth | Early product validation, strategy decisions | Strong growth predictor; prioritizes features |

| Activation Rate | Medium - custom event tracking | Medium - product analytics | Predicts onboarding success & retention | Onboarding optimization, user engagement | Correlates with retention; identifies friction |

Transforming Data into Decisive Leadership

Navigating the complex landscape of product development without a firm grasp on data is like sailing without a compass. Throughout this guide, we've dissected the seven essential pillars of product intelligence, moving beyond mere definitions to explore the strategic application of each one. From the broad pulse of Monthly Active Users (MAU) to the critical health indicator of Churn Rate, each metric offers a unique lens through which to view your product's performance and potential.

We have seen that understanding Customer Acquisition Cost (CAC) in isolation is incomplete. Its true power is only unlocked when benchmarked against Customer Lifetime Value (CLV), providing a clear verdict on the sustainability of your growth engine. Similarly, the Activation Rate offers a crucial early signal of long-term retention, while the Product-Market Fit Score and Net Promoter Score (NPS) provide direct, unfiltered feedback from the most important source: your users. These aren't just numbers on a dashboard; they are the vital signs of your business.

From Measurement to Mastery

The central takeaway is that mastering these key product metrics is not about becoming a data scientist. It's about developing data fluency, the ability to translate quantitative signals into qualitative understanding and, ultimately, into decisive action. Your role as a leader is to build a culture where data is not a tool for blame but a catalyst for curiosity and continuous improvement.

Your next steps should involve a strategic audit of your current measurement practices:

- Holistic Integration: Are you viewing these metrics in a connected ecosystem, or are they siloed within different teams? Start connecting the dots, for instance, by analyzing how a dip in NPS correlates with a future rise in churn.

- Action-Oriented Dashboards: Move beyond passive reporting. For each key metric, define clear thresholds that trigger specific actions or discussions. What does a 10% drop in Activation Rate mean for the product team's weekly priorities?

- Narrative Building: Use these metrics to craft a compelling story about your product's journey. This narrative becomes the backbone of your roadmap presentations, investor updates, and internal communications, aligning everyone toward a common, measurable goal.

Leading with Data-Driven Conviction

Ultimately, the goal is to evolve from reactive problem-solving to proactive, predictive leadership. The metrics we have explored are your instruments for engineering growth, mitigating risk, and building products that customers not only use but champion. By embedding these key product metrics into the very fabric of your strategic planning and operational rhythm, you transform them from abstract figures into a powerful, unifying language that drives your entire organization forward. This transition from intuition-based decisions to data-informed conviction is what separates good product leaders from great ones.

True mastery involves not just tracking these numbers but knowing how to influence them through strategic coaching and refined execution. For executives and product leaders ready to translate this knowledge into a powerful competitive advantage, specialized guidance can be a significant accelerator. Matthew Mamet offers expert growth and leadership coaching designed to help you transform key product metrics into actionable playbooks that foster a culture of high performance and drive sustainable results.

Ready to drive more growth & achieve bigger impact?

Leverage my 25+ years of successes and failures to unlock your growth and achieve results you never thought possible.

Get Started